Understanding Spanish Non-Residence Tax (IRNR): A Brief Guide

Your Guide to Spanish Non-Residence Tax

Welcome to Hola Properties! We’re here to make complex topics like Spanish Non-Residence Tax (Impuesto sobre la Renta de No Residentes or IRNR) feel as easy as a day at the beach.

What’s the Deal with Spanish Non-Residence Tax?

So, you’ve found your dream property in sunny Spain. Fantastic! Now, let’s chat about Spanish Non-Residence Tax, a little something that comes with owning property here.

Who’s in the Non-Resident Club?

First things first, who needs to pay this tax? If you’re not a permanent resident of Spain and you own property here, you’re in. This applies to both EU and non-EU citizens.

How’s It Calculated?

Now, let’s talk numbers. IRNR is based on a percentage of your property’s assessed value (known as the cadastral value). This value, determined by the Spanish tax authorities, is usually less than the property’s market value. The tax rate depends on your property type:

- Urban Properties (like swanky apartments or cozy townhouses): Usually, it’s around 1.1% of the cadastral value.

- Rural Properties (fancy villas or charming fincas): These often clock in at 2% of the cadastral value.

When and How to Handle IRNR

IRNR is an annual affair, aligning with the calendar year. To stay on top of things, follow these steps:

- Calculate Your Tax: Figure out the amount due by applying the tax rate to your property’s cadastral value.

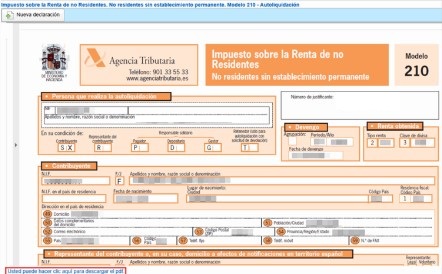

- Fill Out Form 210: Grab Form 210, the tax declaration form for non-resident property owners. You can find it on the Spanish tax authority’s website.

- Pay Up: Settle the calculated tax amount via a Spanish bank or authorized financial institutions. Do this before December 31st to dodge any penalties.

- Keep Records: Hang on to payment records; they might come in handy down the road.

In a Nutshell

To sum it up, IRNR is the non-resident property owner’s responsibility in Spain. The amount you pay depends on your property type. Use Form 210, pay before December 31st, and keep records.

Feeling overwhelmed? Don’t worry; you’re not alone. At Hola Properties, we’ve got your back. Whether you’re considering becoming a resident or just need a helping hand navigating the property world, our experts are here for you. Get in touch, and let’s make your Spanish property journey as smooth as sangria on a summer’s day! i fyou need any help at all with completing your forms and paying your taxes, just get in touch, we are here to help

Now, go enjoy your piece of paradise in Spain. Cheers to the good life! 🏖️🌞

For more advice articles like this just click here

For videos on how to deal with your Spanish tax affairs, just click here